PROGRESSIVE REAL ESTATE APPRAISAL EDUCATION COMMITTEE (PREAEC)

Chris Starkey, MAI, Senior Managing Director, Integra Realty Resources – Orlando | Incoming President, East Florida Chapter Appraisal Institute

Hal Katz, Chairman, Progressive Real Estate Appraisal Education Committee (PREAEC) | Marketing Director, Central Florida Real Estate Forum – East Florida Chapter Appraisal Institute | Executive Committee, Dr. P. Phillips Real Estate Institute, University of Central Florida | Vice President, Commercial Appraisal Department, Hancock Whitney Bank, Orlando, FL

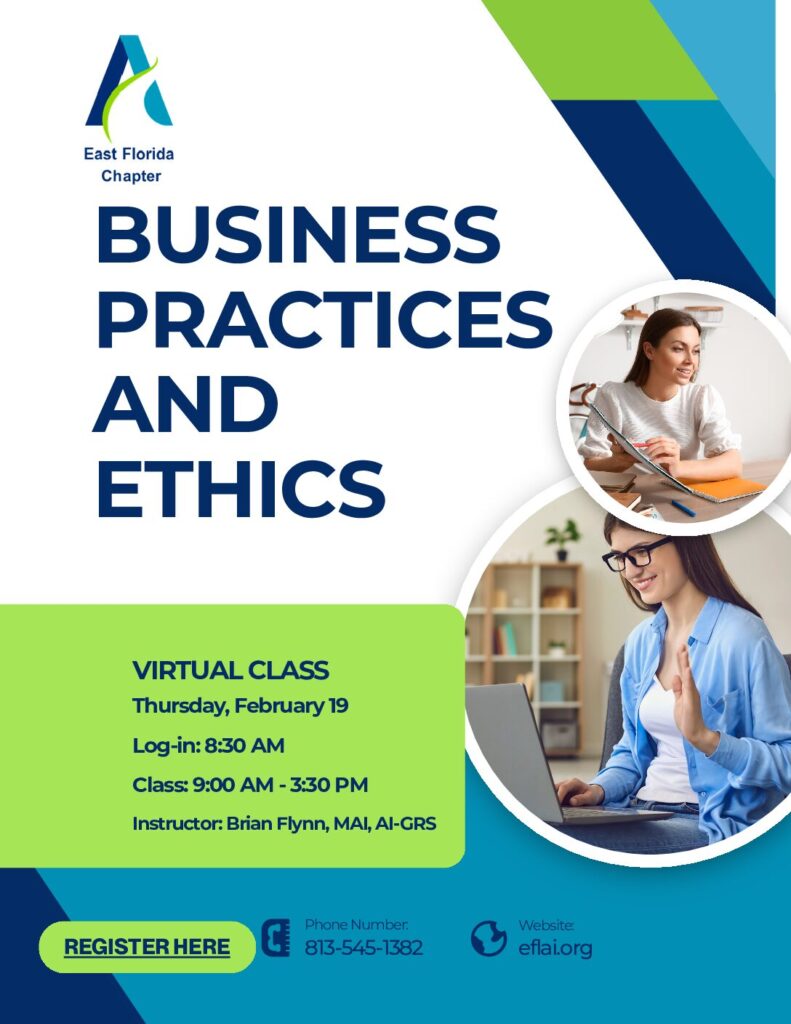

Lauren Dowling, Executive Director East Florida Chapter Appraisal Institute

Laurie Botts, Real Estate Division Manager of the City of Orlando | Adjunct Teacher of Finance Dr. P. Phillips Real Estate Institute, University of Central Florida

Ryan Zink, MAI, Senior Managing Director, Partner, Valbridge Property Advisors | Education Development, Progressive Real Estate Appraisal Education Committee (PREAEC) | Chairperson – Appraisal Institute University Relations Panel | Trustee – Appraisal Institute Education Trust & Relief Fund | Executive Committee, Dr. P. Phillips Real Estate Institute, University of Central Florida

Sheila Potts, CCIM, Director of the Dr. P. Phillips Institute for Research & Education in Real Estate | Instructor Department of Finance and the Dr. P. Phillips School of Real Estate at the University of Central Florida